Albert Einstein once said, “Try not to become a man of success, but rather try to become a man of value”. Similarly, in the world of intense competition, every business entity works on certain principles and beliefs which are nothing but the values. Values lay the foundation for sustainability.

Generally, people do a business to earn a profit. Capital is invested to earn returns. However, a person should not focus solely on profitability from business; they should instead equally consider the values of the business.

The main theme of values-based banking (VBB) is to bring the voice of people into finance. Values-based banking is purposively oriented towards the development of a sustainable economy. Values-based banking is characterised by culture and performance.

Human beings are thought to be different from other animals because they are intelligent beings who can think of others. As a human being, we need to think about the protection of the environment as well as the protection of our planet. The principles of VBB are followings:

- Triple bottom line (P3: people, planet and prosperity) approach at the heart of the business model

- Grounded in communities, serving the real economy and enabling new business models to meet the needs of both

- Long-term relationships with clients and a direct understanding of their economic activities and the risks involved

- Long-term, self-sustaining, and resilient to outside disruptions

- Transparent and inclusive governance

- All of these principles embedded in the culture of the bank

If a citizen does not think about the development of their country and does not contribute to its development, they cannot be considered a responsible citizen. Therefore, the banks also should make policy by keeping the country’s interest in priority and should be able to support in the country’s economic development by investing in the real sector that contributes to the country’s economic development. The banks should join hands with the communities and work for them.

Since banking is a long-term business, we should not think about the short-term benefits only, so it is important to make the long-term benefits and relationships with customers and other stakeholders. Researches reveal that many banks and other businesses have become problematic due to a focus on short-term strategies.

The Institute for Social Banking found in a survey and reviews of the practices of values-based banks that the most mentioned value is ‘transparency’. Since the main obligation of banks is to protect the deposits/assets of depositors, there is a need for more transparency in this sector. At present, customers are more confident with banks than in other sectors due to transparency. The Global Alliance for Banking on Values (GABVs), an independent network of the world’s leading values-based banks, believes that transparency is the most important driver of change in finance, as it is crucial to informing customer choice.

The banks should adopt all the above principles and develop necessary products, policies and manuals. Thoughts for society should be made a culture of the banks; as a result, this culture should be developed for all employees.

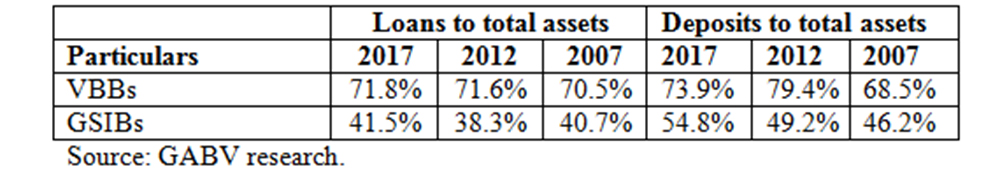

The above data shows that serving the real economy delivers better and more stable financial returns than by the largest banks in the world, the global systemically important banks (GSIBs). Since 2012, the GABV has been publishing research comparing the results of VBBs with the GSIBs.

In total, 55 member banks and seven strategic partners have been associated with the GABP in various countries across Asia, Africa, Australia, Latin America, North America and Europe till the end of April 2019. The NMB bank limited is an only member bank of the GABP from Nepal.

A value-based implementation (VBI) scorecard has been developed to make measurements of values-based banking. The performance in the following sectors measure the VBI:

- Financial sustainability

- Level of support to the real economy

- Value creation to wider stakeholders

In order to bring good results in these three performance indicators, the bank management should design suitable banking products and policies. The banks’ goals cannot be achieved without good human resources, so special attention should be paid by the management to develop capable human resources.

The arrangement for monitoring and reporting statement of the VBI should be made at regular intervals. The proactive leaders, an effective organisational structure and management system is essential for the successful implementation of the VBB.

Due to the increasing competition, new risks are evolving in the financial market every day. If the banks fail to manage the risks, it would be a big problem for the economy of the country, and it may lead to the financial crisis.

The VBB sets out to build a stable economy because the banks can perform well in a stable economy. Besides, the VBB is a mission beyond profit to improve the quality of the world’s banking system. This means, in agreeing to be a part of the values-based banking, each bank would be live by the client-centred principle, long-term resilience, transparency, working for the real economy and so on. As such, the VBB brings healthy ecosystems, healthy livelihoods, and healthy human communities enhancing environmental sustainability.