An IPO, or Initial Public Offering, marks the initial instance when a private company introduces its shares to the public, enabling both individuals and institutional investors to acquire ownership stakes. Businesses opt for an IPO to secure funds for various objectives such as expanding operations, reducing debt, or fulfilling other corporate needs. Additionally, it facilitates liquidity for current shareholders.

In the primary market, there are three main types:

The sequence is typically IPO first, followed by FPO, and then the issuance of rights shares. It is important to note that this structure indicates a buy-only market. If you want to share or trade the IPOs you will need to enter the secondary market.

How does a company go public?

A company going public or undergoing an Initial Public Offering (IPO) marks the first time it offers its shares to the public. This allows both individual and institutional investors to become shareholders. Companies seeking to go public must disclose comprehensive financial information in a prospectus including income statements, balance sheets, cash flow statements, and risk factors.

Investment banks typically serve as underwriters (usually banking organisations), assisting the company in determining the IPO price, marketing the shares, and managing the overall offering process. The company often raises extra capital to fund the IPO process.

Investing in IPOs comes with inherent risks. Investors should thoroughly assess the company’s business model, financial health, competitive landscape, and other relevant factors before deciding to participate.

Why do companies go public?

Companies may decide to go public for various reasons. One key motivation is the ability to raise additional capital by offering shares to the public. The generated funds can be utilised to expand the business, facilitate acquisitions through share conversions, diversify ownership, support research and development, or settle outstanding debts.

Opting for a public offering is often considered a reasonable choice compared to alternative capital-raising avenues such as relying on venture capitalists, private investors, or securing bank loans. Going public can also provide a significant amount of publicity, enhancing the company’s visibility.

Moreover, becoming a public company may enable favourable terms from lenders, as the increased transparency resulting from regular audits and public reports instils confidence. However, it’s important to note that this transparency comes with significant costs, including legal, accounting, and marketing expenses, many of which are ongoing.

Additionally, public companies may enjoy more favourable credit borrowing terms compared to private entities. Nevertheless, the process of going public may introduce complexities, such as diversifying ownership, imposing restrictions on management, and subjecting the company to regulatory constraints.

What do you need to apply for IPOs?

To fulfil the requirements for filling IPOs, follow these steps:

- Ensure you have a bank account (savings). You will have to fill up the form for the particular bank.

- Select a Depository Participant (DP) registered with the CDSC. There are 112 licensed DPs available, and you can choose any one of them to open an account.

- Open a Demat account with the chosen DP. Upon opening the account, you will receive a BOID number and CRN number.

Find a step-by-step guide here: How to open a Demat account?

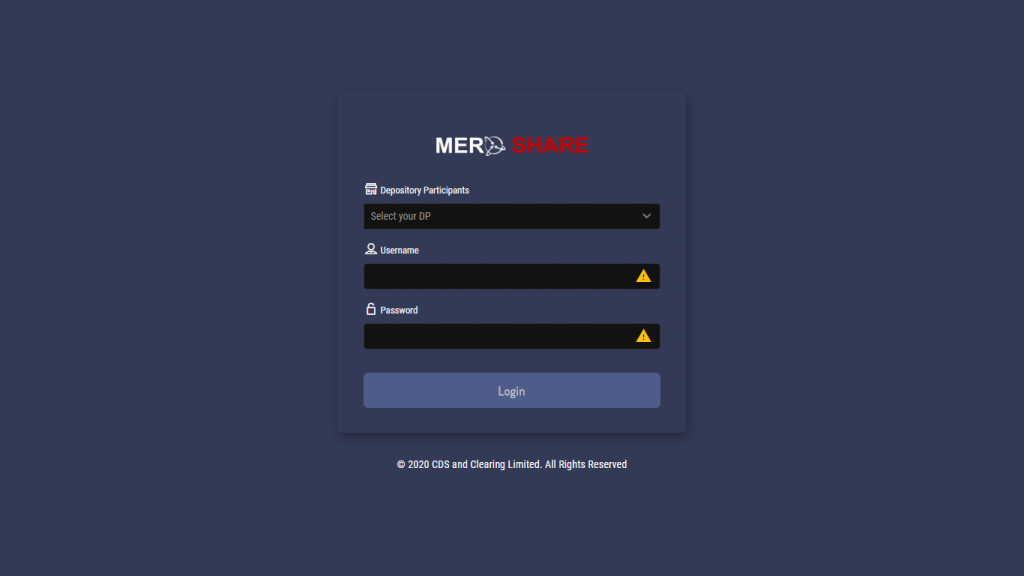

- Open a Mero Share account.

- Apply for CASBA (C-ASBA), an online ASBA service provided by CDS & Clearing LTD to Demat account holders who have taken the “Meroshare” online service through their respective Depository Participants. C-ASBA is a convenient and speedy way of applying for newly issued shares (IPO/FPO/Mutual Fund).

After applying for CASBA, you will receive a username and password to use for further transactions.

Important documents

- Proof of identity (e.g., citizenship certificate, passport, driving license or any government-issued ID)

- Proof of address (e.g., utility bill, bank statement)

- Passport-sized photographs

- PAN card (Permanent Account Number)

If you have a nominee (recommended) you will need the same papers or documents for them as well.

[Note: Specific requirements and procedures may vary slightly depending on the DP you choose.]

How to apply for an IPO?

To apply for an IPO, follow these steps:

- Access the Meroshare mobile application or web platform.

- Log in to your account by providing the name of your Depository Participant, your username, and password.

[Note: If it’s your first login, you’ll be prompted to change your password.]

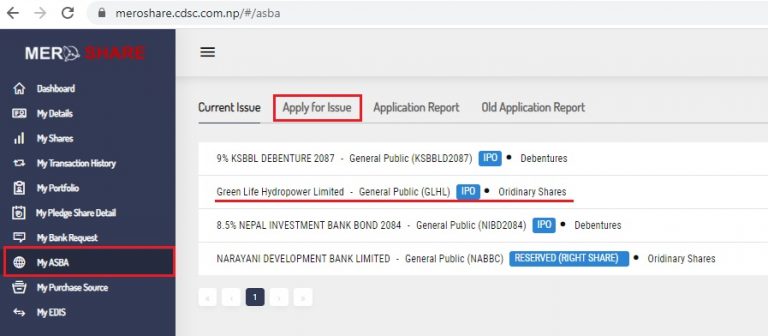

- Navigate to the “My AsBa” section

Under the “Current Issue” section you will find the current IPO issues available for application. Under “Apply for Issue,” select the desired IPO and proceed to the application.

- Click on “Apply” and carefully review the details before submitting your application.

- Choose your DP/bank and enter the number in “Applied Kitta” (e.g., 10 to the maximum mentioned for the specific IPO, like 10000).

- Enter the amount, ensuring that there is sufficient balance in your bank account.

[Note: Upon application, the amount will be on hold in your account. The minimum is 10 shares worth up to Rs 1000.]

- Provide the CRN number received from your bank.

- Select the declaration and input your transaction PIN. Remember to verify all details before submitting your IPO application. Then click “Apply”.

[Note: If you haven’t set your PIN, do so in the profile section before applying.]

- Check the “Application Report”. This will list the shares you’ve applied for.

- Explore the “My Portfolio” section to view the shares you own.